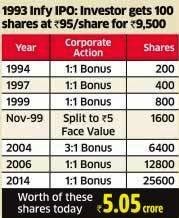

I know several people who had bought infosys and sold it in 2-3 years, i happen to know even employees who sold off the stock, very few thought if the company is doing well and continues to grow, why should i bother about the stock price. To compare the house that i grew up in was owned and we never bothered about its price / growth in price, it was a home to live in. If Infy shareholders had the same long term holding capacity as they had for their house, gold and other tangible assets, they would today be dollar millionaires and the dividend would be enough to lead a good life !! Trick is to think of financial assets like we do our other intangible assets such as house, gold even silver articles and even brass utensils that we pass on from generation to generation without bothering to check the price.

Image and data source : Economic Times.

]]>

A small note on the topic for which i contributed in Economic Time recently published.

]]>

Spanish Finance minister, Feb 2010

2. Portugal is not Greece – the Economist,

22nd April 2010

3. Greece is not Ireland – George

Papaconstantinou, Greek Finance minister, 8th November 2010

4. Spain is neither Ireland nor Portugal –

Elena Salgado, Spanish Finance minister, 16 November 2010

5. Neither Spain nor Portugal is Ireland – Angel Gurria, Secretary-general OECD,

18th Nov 2010

Thanks to Joseph Pulikken for the above ‘quotable quotes’

]]>With the benchmark 10 year bond at 8%, it would be better to start investing in Gilt Funds now with a 1-2 year time frame. If the interest do co ntinue to move up as expected one can average the purchase at 8.5% and then at 9% again. The returns at 8% is good (pre tax, pre expenses) if the interest rates fall by any chance due to some global / local events the returns could really be great.

]]>http://www.livemint.com/2010/03/18212346/Can8217t-wait-to-hang-up-hi.html

]]>http://www.livemint.com/2010/02/04190612/Mum8217s-money-lessons-be.html?atype=tp

]]>Only Adam Smith would have thought about a statement such as this “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.”

These words are the basis of capitalism and will forever remain so.

The link below shows a sculpture based on the spinning top, a tribute to Adam Smith,

http://www.spacestationx.com/projector/cp-Pages/Image38.html

]]>http://sify.com/finance/Myths-about-mutual-funds-imagegallery-market-jl0sqWfdegf.html

]]>The takeaway for investors is that in the markets we tend to focus on one thing say maximizing profits at the cost protecting from losses or vice-versa. The focus magnifies the issue and distorts our thinking.

]]>