Sensex @60,000 !

In the last blog written in March 2021 ( a good 6 months ago!) had mentioned that what a difference a year can make comparing to March 2020 and how most of our investors had maintained social distance from their portfolios and it had helped as the markets bounced back from 25000 in March 2020 t0 50000 in March 2021. See the blog here : http://blog.credocap.com/?p=502

Today it seems euphoric to be at 60,000. But the journey has been anything but easy. For almost entire 1990s to mid 2000, it was a cyclical market with 5000-5500 being top and 2000-3000 being low, as one after another scams came and went and scary things like 9/11, Kargil happened. Somewhere around early to mid 2000 we had an infra boom and the world also had an excellent rally and broke above 5000 levels and went to 20000 in 2008 moving 4 times in less than 4 years, This was a rally like no other, global in scale from RE boom in remote areas of India to stocks world over everything rallied till Lehman brothers collapsed, from 20000 sensex fell to 9000 in a years time, though we moved up fast too, it took almost 7 years to reach 20000 again in 2013.

In 2020 just as the virus news was surfacing in early Feb, Sensex was near 41000 and it fell to 27000 (almost 35% in one month) but back then most of us were worried about health too much to bother about wealth but many pulled out of markets completely.

Today we are 60000 or almost 50% higher than Feb 2020 and that is a good return to get.

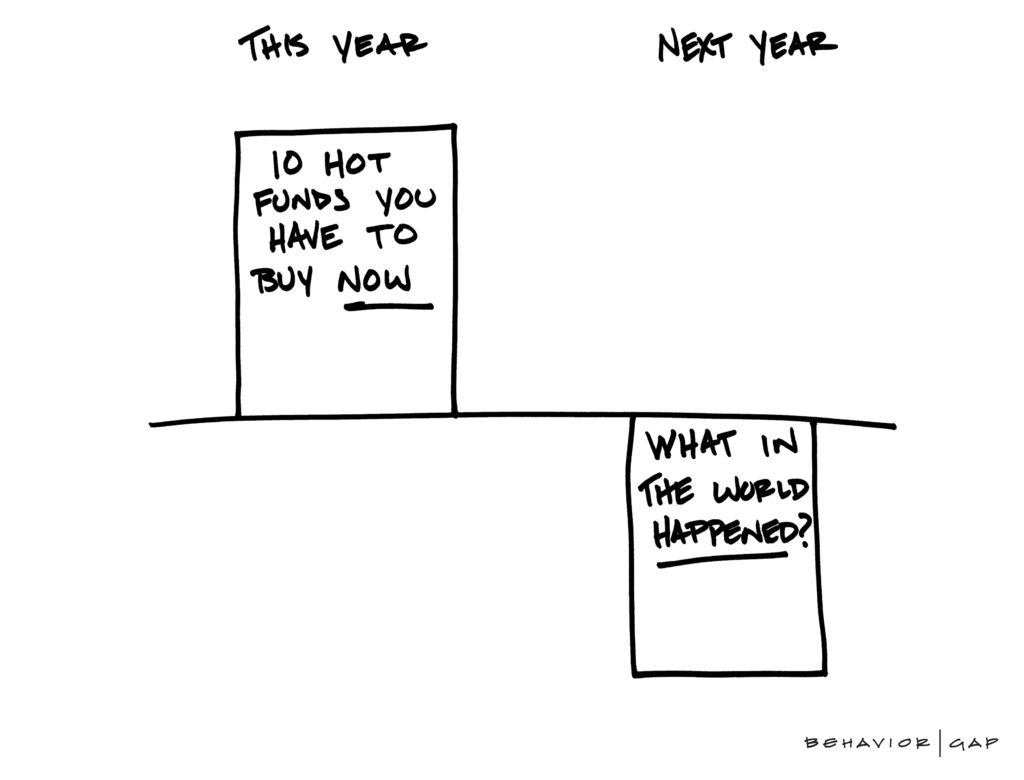

The gist of what im trying to convey the journey from 3000-60000 a 20 times return in 20 odd years comes with great ups and downs and from what we see above, 5000 was an euphoric high in 2000 but 9000 in 2007 was considered low as it had fallen from 20000 to 9000. And in 2020, 27000 was considered very low. These highs and lows will keep changing but what is clear is that over time markets keep making new highs, and that in between for many years may be 3-4 or even 7-8 years they move in a see saw doing nothing with no returns, and then in 2-3 years move up 5 times to make good all the years of no returns and much more.

The net result of all this is not severe migraine but wealth creation, Franklin Bluechip Fund rated just 2 stars, out of five, has given around 16% p,a since 2000, in other words 1 Lac becomes 25 Lacs in 21 years at that rate of return. But not many held on or kept investing, No need to keep invested in the same fund but staying invested in equities made a huge difference to many investors lives. Indeed many of you who have been clients for almost since 2001 when i was working and since 2007 when i started out Credo, have been around and got good returns, Thank you for being with us and happy to have helped on your investing journey in a small way.

On a closing note, need to understand that equities are not a place to be euphoric at 60000 or despair at 30000 ! but keep asset allocation between equity and debt in good ratio, and have a plan for higher equity as markets go down and lower as it goes up (this also depends on individuals unique circumstances). Do let us know if you want to check your equity allocation and take a call to reduce equity if need be. would be happy to help.

Happy investing,

Disclaimer :