What uncles and aunts can teach you that the business newspapers will not.

If you are going to invest in stocks over the next five years, would you hope for a higher or lower stock prices during that period? Many investors get this one wrong, they are elated by higher prices and depressed when they fall. This reaction makes no sense – Warren Buffett.

There are 60,000 economists in the U.S., many of them employed full-time trying to forecast recessions and interest rates, and if they could do it successfully twice in a row, they’d all be millionaires by now…as far as I know, most of them are still gainfully employed, which ought to tell us something. – Peter Lynch

We can say the same thing about our business news people too. Thing is investing is all about ten,twenty years from now while writing headlines is all about today, not exactly co-related.

“Blood bath on Dalal street”, claims the newspapers headlines following the 700 point drop in Sensex on August 16th. Do google blood bath on dalal street and you shall see that every year ‘blood-bath’ occurs. Leading one to think that probably it is a scary place for people to set foot in!

Today, the investors interest in equity stocks and funds is so low that not many investors are around but if you see people who have made serious wealth over the long term, they are likely to have started small, kept investing, learn a thing or two about what fund or stocks to buy etc but more importantly never let the headline be their guide for investments.

And if you thought that is a tough thing to do meet Mrs Ashalatha Maheshwari from Mumbai, this 77 year old grandmother has seen a thing or two since she started investing in 70’s. Her investments are about 4 Crs, apart from this the house she lives in was bought from the profits she made by investing too. She reads annual reports diligently and is a fixture in most Annual General Meetings so much so that even Ratan Tata remembers her!

Not convinced ?

In my sleepy little home town we had an investor association that met every month, I came across a middle aged person who was the quintessential middle class guy, living in a small house, driving a moped, you would expect him to be working for some bank and you would be seriously wrong. he would talk to us about how it is best to invest for long term in companies with great brands, captive business etc. Nothing esoteric just basic steps of long term investing. Many years later I learned that this ‘uncle’ who moved around in a TVS50 was worth a cool couple of crores and that was a decade back ! All made by diligently investing in great brands and good businesses with excellent managements like Colgate, HLL, ITC, CRISIL etc. He was in a way our own Warren Buffett. HE was financially independent, yet unassuming and ready to teach anyone who cared to listen.

Both the ‘uncle’ and grandmother featured above would have gone through recessions, inflation, balance of payment crisis, etc. and kept investing.

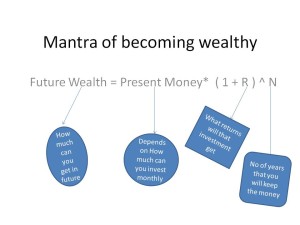

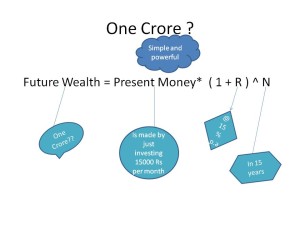

OF course not all investors can be expected to study balance sheets and find which stocks to pick, it is much easier to invest in a Mutual Fund via monthly investments, but no, we don’t do that. We start investing keep at it for couple of years only to see the low rate of return and stop investing. Of course we will start investing again after market goes up !! Rinse & Repeat till glory comes. That will never work, what works is keep investing when there is blood bath all around, in fact invest more when you hear words like Blood-bath, Mayhem, crisis, etc.

If you go to you tube and search for the short film One Idiot, made by IDFC Foundation on habits that make an investor successful though, the message is clear. There is a path to financial independence and leading life in your own terms.

Notes : http://blogs.wsj.com/indiarealtime/2013/08/01/the-grandmother-with-faith-in-indian-stocks/

http://www.youtube.com/watch?v=vU1l1TB7GzI