What can 14% returns do? A lot as we see :)

In 1971, Govt’s Enemy Property Office had shares worth Rs. 29 Cr’s value mostly belonging to people who left India during Indo Pak war of 1965. Cut to 2015, exactly 44 years later, the shares have been valued at 10,000 Cr. That is approximately 345 times in 45 years !

Imagine what % return per year it must have taken to grow by 345 times ?

approximately 14%, that is all. Over 44 years that 14% made 29 Crs turn into 10,000 Crs !! This was a static investment on which nothing was done, This is not all, the dividend last year alone on this was some 40 Crs ! The 14% return does not include dividends. This is what equities can do over long periods of time, create real wealth.

But hardly anyone invests in equity or equity mutual funds and those who do don’t stay invested for more than 2-3 years, forget 20 0r 30 years !! Only 20 or 30 years can create wealth, buying and selling every 1- 2 years will create lots of paper work and not wealth !!

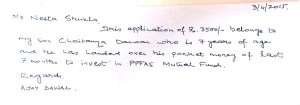

Moral of the story : Invest for really long periods to create wealth, Don’t have 29 crs to invest for next 44 years ? Don’t worry, I don’t have too 🙂 but surely some of us can invest Rs.10000 p.m over next 20 years, at the same 14% that can turn into Rs. 1.31 Cr’s.I’m fine with that, and guess you will be too 🙂

Source for the news on Enemy Property :

http://www.business-standard.com/article/markets/enemy-shares-to-be-dematerialised-115041700037_1.html