High end investing and low end returns

Most of us dream of owning a high end car or bike ( Harley this or BMW that ) because those vehicles arguably are the best in class and are seen as exclusive. This works exactly opposite in investments. Many people, especially the high net worth investors get caught in this trap of exclusivity-is-better while investing.

This was sadly discovered by the singer Suchitra Krishnamurthy who was a ‘privilege’ customer of a large foreign bank. Check the link for the full story.

Sadly, this not an one off event and has happened to many. Even public sector banks are not immune to this disease of selling toxic investment products to their ever believing customers who believe that anything sold by a ‘government’ bank or insurance company is safe. Check out the link below for an example.

http://www.livemint.com/Money/57wQlkkdLuC8GvifojfdMK/How-to-shrink-50000-to-248.html

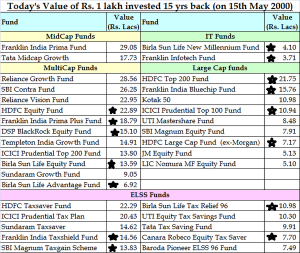

In investing, simple stuff works best. In the past highest return came from buying-and-holding on to investments like equity mutual funds for 20 years( 16%+ p.a from equity funds).

But as one’s wealth grows, it attracts lots of attention foremost from your bank as they are fully ‘aware’ of your account balance. You will be tempted with Gold Privilege Account, Private banking, exclusive relationship manager along with free invitations to concerts, limitless credit cards and other such knick-knacks.

While buying any investment please remember that what matters most is

1. Where is the money being invested ?

2. What is the cost ?

3. What is long term track record of returns ?

4. How quickly can you sell?

5. What are the charges for selling?

Read all this in the application form before signing. Many who happily sign on the dotted line without reading do not realize that their hard earned wealth is being invested in things that can not be sold easily, has high costs and mostly low returns.

What is the solution for the investor then ? Whether one is a HNI or not, I suggest sticking to simple open ended equity funds that have been around for 10 years or more (only if you have the patience to wait for next 10 years at least). While mutual funds do not guarantee any returns, they are the most transparent investment products and are well regulated. While future returns can vary, they will likely remain the best option for wealth creation.

So next time when some one tries to push an investment plan along your way, please remember that it is not a good idea to mix investments and insurance, Term Insurance is what most of us require for protection and investments are for growth, keep it simple and separate.

PS : I advise on mutual funds and hence am biased towards it and against other products. But most of what i write is from my personal experience of seeing investors suffer after buying products with long lock-ins and low returns.