Is it a good time to invest?

“Stock market is a mechanism for moving money from the impatient to the patient” Warren Buffett.

The most frequently asked question to me as an investment adviser is:

“Is it a good time to invest”?

My answer depends on

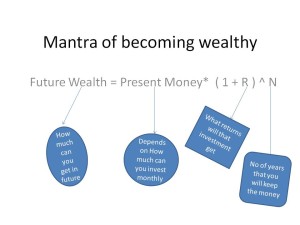

- How much ‘time’ will you give for the investment to grow?

- Are you investing to get rich ‘quick’ ? or do you want to create wealth over a long period of time?

Getting Rich Quick

Buying a fund or stock at Rs 10 and selling it at Rs 15 after a good year or two is getting rich quick. We can call ourselves smart for getting 50% returns in a short time. The flip side is that the timing can be wrong and you could end up losing money too as no one can predict short term movements.

Creating wealth slowly

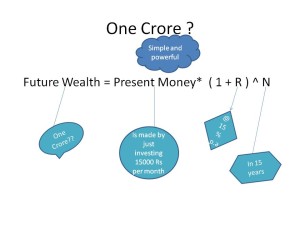

Creating wealth slowly but surely on other hand involves investing monthly bit by bit and holding on to to your investments for at least a decade or two. Here is an example. Rs. 5000 per month invested in an equity fund like Franklin India Bluechip for last 20 years has resulted in a wealth of around 1 cr. And what was the total amount invested? Just Rs. 12 Lacs over a 20 year period grew at 20% per year (on an average, some years were up 40% and some down 20% or more)

This is an excellent example of get rich slowly but surely. Will the past return of 20% p.a be repeated in future ? Im not sure, but 15% p.a is quite possible. Would investing Rs. 5000 p.m been a big commitment back in 1995? I was studying in college then so could not have afforded it. I know people who could have, but did not.

The brighter side is you can invest higher sums even today as salaries have risen compared to 1995, if, you invest Rs. 25000 monthly now for 15% return your wealth can grow to Rs. 3.78 Crs after 20 years. As an investor I’m sure you would be happy with this kind of wealth any day.

A slow and steady disciplined approach to wealth creation far is better than jumping in and out of markets assuming that one can get rich quick. It is always better to be the steadfast tortoise than the fast running hare.