Few days back i read this report in Mint about how much waiting in traffic jam costs you ?

http://www.livemint.com/Money/VX3SyEKsUZ8kYIldFVQXYL/What-is-the-daily-traffic-jam-costing-you.html

The report says you spend 20% more fuel waiting in a traffic jam. I was more worried about the time spent say half an hour one way stuck in jam, that’s an hour a day, time that can be spent better.

I thought about this from the angle of our financial lives, and what causes financial traffic jams and what is the solution.

Are you keeping too much money in Savings account ?

So, this money is stuck in large jam hardly earning 4% p.a interest ( which btw, is fully taxable). Check when you need the money. If you don’t need it for a year FD is better, if not required for 3 years you can look at Bond Mutual FUnds that are more tax efficient than FDs and if not needed for 5 years or more you can consider balanced or equity funds.

Are you keeping too much in FD’s and Gold ?

I know people who have more or less their entire investments only in FDs. This is being too conservative like having a top notch SUV but never using it !. If the money in FD is not required for many years there are better ways to let it grow. This is the traffic jam most Indians are at today. FDs can be a part of your investment kitty but not only FD. It is a losing propositon basically as taxes and inflation eat away your interest. Since they are safe people prefer them but just like we can’t stay at home all day since it is safe, similarly you can’t have all your money in FDs. The same goes for Gold – at least FDs give some interest, gold gives nothing, in fact takes away as you pay making charges for jewelry and locker charges to the bank.

A good portfolio has mix of investment that works for you? FD for emergencies, Debt Mutual Funds for expenses coming up in three years, Mutual funds with debt and equity for > 5 year goals and Equity Fund for > 10 year goals.

As in past posts let me remind that insurance is like seat belt or helmet only to protect you and not give returns so don’t invest in insurance plans with an aim to make money but only for security with a term plan.

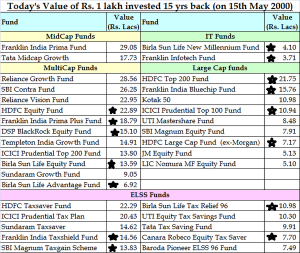

See the chart below of how much equities ( represented via Sensex ) has delivered. I’m not saying the same returns will be repeated but saying there is no ignoring equities as it remains the best asset class for long term investors.

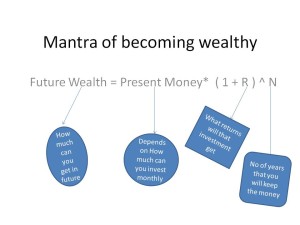

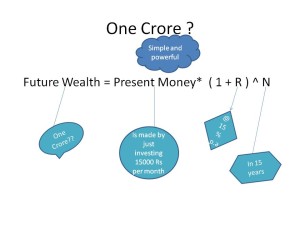

The above return is for the sensex. A better metric would be to measure equity mutual funds that have been around for > 10 years. Most of equity funds have delivered around 15-20% pa. So you definitely need equity investments if you would like to escape the traffic jam of Gold and FDs. At 15% returns, a Rs. 10000 monthly investment can grow to Rs. 1.5 Cr in 20 years.

In our daily routine, we can’t avoid traffic jams but atleast ensure that your money is not caught in one.

A word of caution : Equities as the link of mint article above is ‘slow cook’ product not suitable for instant noodle types ! You would need to invest regularly ( monthly) give it 10 -15 years to create real wealth. It is about becoming wealthy not getting rich quick !

Happy Independence Day, plan for your financial freedom this year.