Secret of Rakesh Jhunjhunwala’s success

Actually, it not a secret at all. But people are curious if we add the word secret 🙂

Rakesh Jhunjhunwalla is a regular on Forbes list of richest Indians and is a billionaire. He is as far as i know the only “investor” in the list, in the sense that his wealth has come from investing, and not from running a company or inheriting wealth. Starting out in 1990’s with a small capital, RJ is the real big bull of Indian stock market.

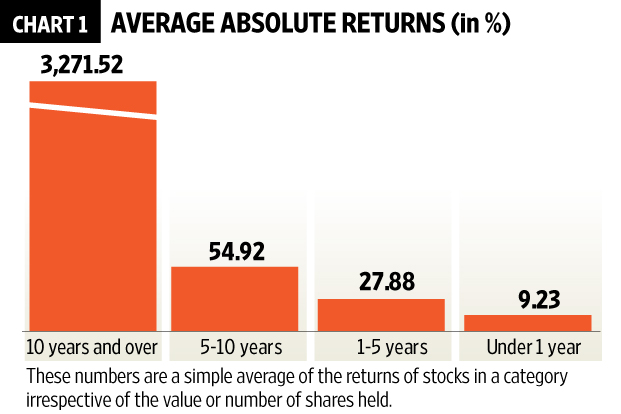

Recently Mint newspaper did a cover story on the secret to his success, turns out that the secret is something all investors know but very few practice, which is holding investments for the long run. Mint analysis of RJs portfolio reveals that his highest returns have come from stocks that he held on for 10 years ( 3 stocks held for >10 years now account for 50% of his known holdings net worth ).

source : http://www.livemint.com/Money/r06HO0RUtK82ReZnxPzKwL/The-secret-of-Rakesh-Jhunjhunwalas-success.html

While RJ must have invested in other stocks which went nowhere over last 10 years too, holding on for more than 10 in these few stocks has resulted in great wealth ( almost Rs. 4000 crs !) . How tempting it must have been to sell when the value reached 100 crs, then 1000 crs etc ??

Compare this with the data that average investor in Mutual Funds hardly hold their investments for just 2 years, it becomes clear that why ordinary investors don’t get high returns.

Over last 20 years, many equity mutual funds have given 20%+ p.a returns, Just Rs. 5000 invested every month is worth Rs. 1.58 Crs against invested amount of Rs. 12 Lacs ( Rs. 5000 * 240 months).

So even a middle class investor can create serious wealth by investing regularly and holding on to those investments for long term.

We already hold our other investments for a long time, be it gold, even FD’s, while these are safe investments they seldom beat inflation and taxes in case of FD and making charges etc in case of gold.

We tend to look at short term volatility in equity and avoid investing but miss out that they create enormous long term wealth.

For many of us researching and holding onto stocks is a tough task given that we are not full time investors, so investing in equities via Systematic Investment Plan of equity mutual funds helps us to create wealth in the long term in the easiest possible way.

Hoping that many of us reading this start out on the path to wealth creation,

For more on SIPs : http://blog.credocap.com/?p=285