3 Simple steps to stress free investing

1. Check and collate all of your investments : Be it Insurance, Mutual Fund, shares, bonds, FD, anything. Put it all one folder, use a good spreadsheet or software ( we use Mprofit) to track all of it in one place. This will not only help you know where you stand but also help you at the right time in filing tax returns. This will take time but will save you lots of pain later. Automation can help you here, if you give same email id across investments it is possible to get one statement for all your MF and equity.

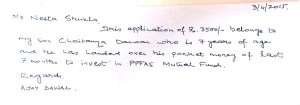

2. Keep investing simple : Investing is about making your money work for you, that is all. 4-5 Mutual Fund schemes via SIP, 1 bank account, 1 term plan and a medical plan that is all one more or less needs. Ensure that there is nominee for all your investments and that you have a will in place. Never buy investments under “pressure”, be it from relatives or bankers.

3. Never sweat the small stuff : Things change everyday, don’t fret. Talking heads on TV are paid to talk, but no one pays you to listen, so don’t. Always think will this decision matter one year or two from now on? If not, it is small stuff, this will be the key question to ask before you take any decision financial or otherwise.

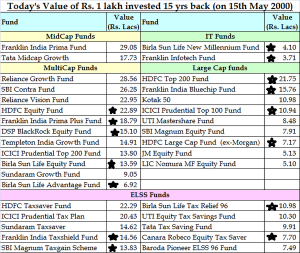

Finally, in life small improvements like small investments make large gains in future. Start today and declutter your investments and you will thank yourselves 2 years down the line.

Happy weekend,

Don’t compare yourself to others. Compare yourself to yourself two years ago.

— MicroCapClub (@iancassel) April 17, 2015