Where is the money to invest?

“We buy things we don’t need, with money we don’t have to impress people we don’t like.” – Dave Ramsay

I love to talk about investing and have addressed groups as diverse as college students and senior bankers. After my talk, I am often asked ” We would love to invest, but we don’t have enough money.”

Do you really think so? I think not! You have money right in your pocket. Confused, are you? Okay, to begin with , have a look at your mobile phone. Some of us own a mobile that costs as much as one’s monthly salary (you ‘smartly’ exchange it for the ‘new’ version every year or so in turn spending one month’s income every year). On top of that we spend a cool thousand rupees or more every month for recharging it. So, think again!.There is money right in your pocket, but you are busy spending it.

Wanna find more money to invest? We all go to malls as a ritual. I do agree that it is indeed fun to see a movie and dine out. But, if you can restrict your outings to twice a month instead of every weekend (after all, as someone rightly said “If you see one mall, you have seen them all”) you will be able to save money, which might roughly translate to Rs. 2000 Rs every month ( Movie tickets+ dinner + parking not to mention the popcorn at Rs. 100 ‘only’). Alternatively , you can go to the beach or a park, play with your children. By doing so you will get to burn some calories instead of money. And, not to forget the “ever-happening and never ending sale” on swipeyourcardtoglory.com !

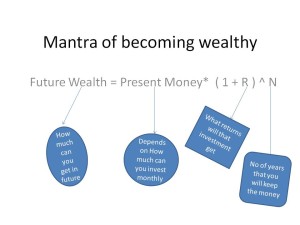

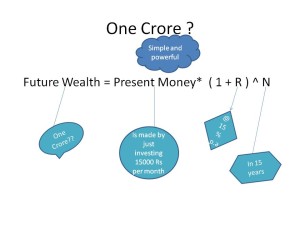

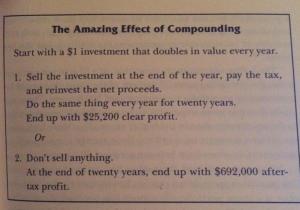

Assume that you are able to invest around Rs. 3000 every month in an equity mutual fund. This could turn into Rs. 45 Lacs ( at 15% returns which is less than the past returns of around 18-20%p.a in equity mutual funds ) over a 20 year period. Now, there is no reason to invest the same amount every year. You can always increase your monthly investment as your salary increases.

Don’t get me wrong! I’m not suggesting that you have be a miser to have a better future. But I am trying to tell you that for a brighter future , you got to spend wisely and invest the rest.By all means, do enjoy your outings and gadgets. But, try to minimize them to essentials and invest money saved. You would get better returns that way!

The problem with most of us is that we have been brainwashed into thinking that spending money will make us happy. It indeed does, but such pleasure lasts till their bills arrive! So, as I said earlier, we have money to invest provided we are a bit prudent about our expenses and save small amounts every month.

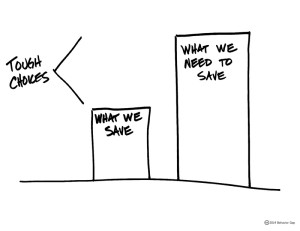

Fellow Certified Financial Planner and speaker Carl Richards put it nicely in his cartoon. I believe that it is not “tough choices” that we have but “sensible choices” we need to make while investing.

Image copyright : Behaviour Gap